Table of Contents

Introduction

In India before the introduction of National Pension Scheme central and state governments used to guarantee pension to their employees.

Whereas, most Private Sector employees managed their routine post retirement through savings accumulated during their work life.

National Pension Scheme (NPS) was introduced by Government in 2009 with an objective to reduce the burden on Government to pay it’s retired employees

Government has set up Pension Fund Regulatory Authority (PFRDA) to regulate NPS.

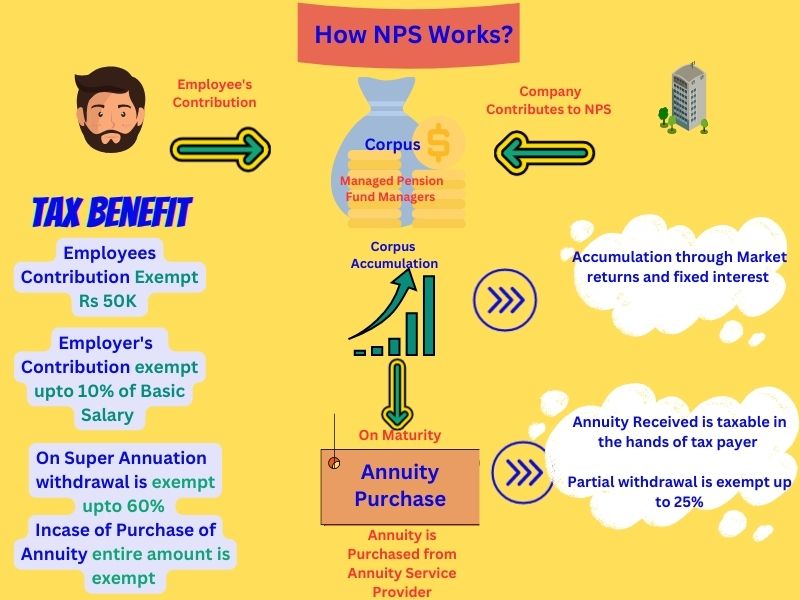

How NPS Works?

National pension scheme works as a fund where, contributions are made by subscriber. The subscribers can be Government or private employees or self employed individual.

Over the period of time the monthly contribution along with its returns accumulates as corpus which is used by the subscriber for purchasing annuity (retirement plan) from Annuity service provider (ASP).

The NPS funds are market linked and are managed by Fund Managers. This Fund Managers are known as Pension Fund Managers.

NPS scheme has 2 types of accounts Tier I and Tier II.

Tier I is non withdraw-able account, till subscriber attends the age of 60 years (except under certain conditions).

Tier II is flexible and allows withdrawal any time.

Pension Fund Managers (PFMS) currently registered by PFRDA includes:-

- HDFC Pension Management Co. Ltd

- ICICI Prudential Pension Fund Management Co. Ltd

- Kotak Mahindra Pension Fund Ltd.

- LIC Pension Fund Ltd.

- SBI Pension Funds Pvt. Ltd.

- UTI Retirement Solutions Ltd.

- Aditya Birla Sun Life Pension Management Ltd.

- Reliance Pension Fund

How Fund Managers Invest your Money in NPS

Subscribers contributes a fixed monthly amount in NPS. He directs the Fund Managers on the approach to be taken on the moneys contributed by him.

Based on the approach Fund Manager will invest in any of the following investments.

| Asset | Description | Risk | Return |

| Equity | Investment in Equity Shares | High | High |

| Corporate Bond | Investment in Bonds issued by Companies | Medium | Medium |

| Govt Bonds | Investment in Government Bonds | Low | Low |

| Alternative Investment Funds (AIFs) | Investment in Real estate investment trust, Commercial Mortgage backed Securities, Infrastructure Investment trust | High | High |

As mentioned earlier, the subscriber decides on the approach of Investment. There are two approached Active and Auto.

Active

Here subscriber can actively decides where he wants his fund manager to invest.

In Active choice, a person can choose the ratio in which he want the funds to be invested. For example he can ask the Fund Manager to invest 75% in equity which is the maximum limit of Investment. The balance can be invested in Government and Corporate Bonds.

A conservative subscriber may reduce the portion in equity to restrict his exposure and invest more in bonds.

The contribution to equity fund cannot exceed 75% of subscribers contribution and Investment in AIFs cannot exceed 5%.

Auto

Subscribers who are not aware of the risk associated with various investment can opt for auto approach

Auto approach provides subscriber with an option to decide on the life cycle of the Fund.

Under Auto approach the investment in various classes of assets is determined by the age of the subscriber.

However the portfolio is different for Government and Private Employees.

Government Employees

| Government Bonds | 100% In Government Bonds |

| Conservative Lifecycle fund | Upper Limit of Equity Investment is capped at 25% |

| Moderate Life Cycle | Upper Limit of Equity Investment is capped at 50% |

Private Employees

| Aggressive (Lifecycle – 75) | Maximum equity exposure is 75% upto the age of 35 |

| Moderate (Lifecycle – 50) | Maximum equity exposure is 50% upto the age of 35 |

| Conservative (Lifecycle – 25) | Maximum equity exposure is 25% upto the age of 35 |

In the lifecycle Fund options, investment gets automatically invested in three classes of assets as per the age of the subscriber. With Increase contribution towards equity investment reduces and towards Government bonds decreases.

Calculation of Return

Investment in National Pension Scheme is like the mutual fund. The subscribers are allotted units for investment.

Just like mutual funds, the net asset value (NAV) of each pension fund is declared at the end of each business day. Performance of your investment is also available on your dashboard at https://cra-nsdl.com/

Commutation on Super Annuation

Once the subscriber reaches the age of 60 years he/she has a following option with regard to purchase of annuity.

Full Annuity Purchase

The subscriber can use 100% accumulated funds in to purchase annuity (retirement plan). The annuity pays a fixed amount of money to the subscriber following retirement.

All Annuity has to purchased from Annuity Service Provider (ASP) empaneled with the regulator (PFRDA).

Currently, following companies are Empanelled as ASP.

- Life Insurance Corporation of India

- HDFC Life Insurance Co. Ltd

- ICICI Prudential Life Insurance Co. Ltd

- SBI Life Insurance Co. Ltd

- Star Union Dai-ichi Life Insurance Co. Ltd

- Kotak Mahindra Life Insurance Co. Ltd.

- IndiaFirst Life Insurance Co. Ltd.

- Max Life Insurance Co. Ltd.

- Canara HSBC Oriental Bank of Commerce Life Insurance Company Limited

- BAJAJ ALLIANZ LIFE INSURANCE COMPANY LIMITED

- Tata AIA Life Insurance Company Ltd.

- Edelweiss Tokio Life Insurance Company Limited

- PNB Metlife India Insurance Company Limited

Commutation with annuity purchase

Subscriber can withdraw upto 60% of the accumulated amount and balance can be used for purchase of annuity.

Continue NPS with or without contribution till 70 years

Subscriber can continue the NPS with or without contribution till the age of 70 years.

Annuity Scheme

The Schemes offered by ASPs are categorised into the following:-

| Annuity Scheme | Description of the scheme |

| Annuity for life and with return of purchase price on death | In this scheme subscriber gets regular monthly pension till the time he is alive. On the death of the subscriber, the payment of annuity ceases. The ASP returns the purchase price to the nominee. |

| Annuity for Life | The subscriber gets regular monthly payment till he/she is alive. On death of the subscriber, the payment of annuity ceases. |

| Annuity payable for life for subscriber and his spouse with the return of purchase price on the death of both them | The subscriber gets regular monthly pension till he/she is alive. On the death of the subscriber, annuity will be paid to the spouse for life time. On the death of the spouse, annuity purchase price will be returned to the nominee |

| Annuity payable for life with 100% annuity payable to spouse on death of the subscriber | The subscriber will get monthly pension till he/she is alive. On death of the subscriber, the annuity will be paid to the spouse for life time. If the spouse predeceases the subscriber, then annuity payment will cease after the the death of the subscriber |

Partial Withdrawal

In case of Tier I, 3 withdrawals are permitted during the entire subscription period within a period of 5 years. Other conditions attached to withdrawal in Tier II are as follows:-

In case of Tier I, 3 withdrawals are permitted during the entire subscription period. There should be a gap of 5 years between each withdrawal except in case of medical emergency. Other conditions for withdrawal from Tier I includes following:-

- Subscriber should be an NPS member for atleast 3 years.

- The amount withdrawn cannot be more than, 25% of the contribution.

Tax Benefits

During Contribution

Benefit to Employees from Employer’s – 80CCD(2) of Income Tax Act

Contribution made by employer to employee’s NPS account is exempt to the extent of 14% of basic salary for Govt Employees. In case of Pvt Sector employees this exemption limit is 10%. This provision is not applicable to self-employed individuals

Benefit to Self Employed – 80CCD(1) of Income Tax Act

Under this section deduction is available to self employed individuals for their contribution to the extent of Rs 1.5lacs This limit is subject to the overall limit of investment as stated in 80C and 80EEE which is Rs 1.5 Lacs.

Benefit for own Contribution – 80CCD(1B) of Income Tax Act

A subscriber can claim additional deduction of Rs 0.5lacs over and above the limit of Rs 1.5 lacs.

Tax Impact during Partial Withdrawal.

Partial withdrawal made by the subscriber from his or her Tier I account upto 25% of contribution is tax free.

Tax benefit on Retirement or Superannuation

The subscriber can purchase annuity using by 40% to 100% from his fund balance as explained in point no 5. The maximum of 60% of the amount can be withdrawn tax free.The annuity amount received by the subscriber on retirement on a monthly basis will be taxable as per the person’s tax slab.

Tax Impact on Premature Exit

The tax implication of premature exit is as follows:

Incase tax deduction is taken then, entire amount of withdrawal will be taxable. If the amount is received by the nominee at the time of death of the subscriber then, it won’t be taxable.

If subscriber opts for annuity scheme after premature exit then, entire amount will be taxable

Q&As on NPS

Is NPS Tax Free on Maturity

A person can withdraw 60% of the corpus as a lump sum and 40% into an annuity plan. Under the new NPS rules, subscribers can withdraw their whole corpus if it is less than Rs 5 lakh without buying an annuity. Tax-free withdrawals.

What is NPS interest rate

NPS doesn’t have a fixed interest rate. The return or increase in corpus depends on Market Performance.

Is NPS better than PF?

NPS and PF are both different schemes. NPS return depends on what sort of investor you are. If you are an aggressive investor and are ready to take more risk by Investing in equity than, returns can be higher. A conservative investor can ask Fund Manager to invest in corporate and Government Bonds and returns can be different for lower risk appetite.

PF is a Government run scheme and interest rate are decided by Government. Both can fall under the category of EEE upto a ceiling limit.

Does NPF Gives Life time Pension

Actually NPS doesn’t give pension. After the closure of account a subscriber has to invest his monies with Annuity Service Provider(ASP). The ASP can provide a list annuity options which decides the period for which Pension is earned

Can we have both NPS and PF

Yes both plans are different and an individual can invest in both